Redundancy/Recouping Lost Earnings

Claiming from the NI Redundancy Payments Service

This document is only relevent to you if you have lost your job and your employer owes you one of the following types of debt:

- Wages

- Holiday Pay

- Statutory notice pay

- Redundancy pay

Focus and Limits of This Document

The purpose of this document is to provide guidance, in relation to each of the relevant debts, on

the following questions:

- Should you make an industrial tribunal claim against your employer?

- Instead, can you make an application, to the Redundancy Payments Service, for a payment in respect of that debt?

It should not be assumed that this document contains a complete, and entirely accurate, or entirely up-to-date statement of all of the relevant legal principles and procedures.

The following information does not constitute legal advice; this document provides general

guidance only.

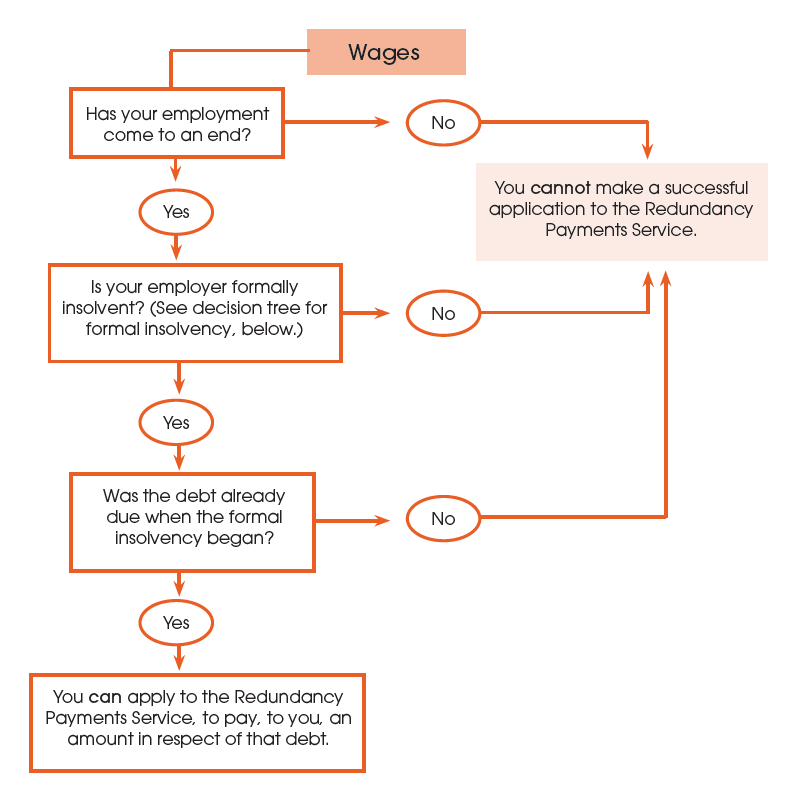

The Wages Decision Tree

In respect of wages debt:

- Should you make an industrial tribunal claim against your employer?

- Or, instead, can you make an application, to the Redundancy Payments Service, for

a payment in respect of that debt

Use the ‘Wages’ decision tree below, for guidance:

If the Redundancy Payments Service makes a payment, to you, in respect of wages, they

can only pay you in respect of a maximum of 8 weeks’ pay.

You will not be paid any more than the statutory limit, which weekly pay is currently capped at £566.

NOTE:

This statutory limit is subject to change each year around April. You can check whether the statutory limit of £566 has changed by visiting:

www.gov.uk/redundancy-your-rights/redundancy-pay

The Holiday Pay Decision Tree

In respect of holiday pay debt:

- Should you make an industrial tribunal claim against your employer?

- Or, instead, can you make an application, to the Redundancy Payments Service, for

a payment in respect of that debt

Use the ‘Holiday Pay’ decision tree below, for guidance:

If the Redundancy Payments Service makes a payment, to you, in respect of wages, they

can only pay you in respect of a maximum of 6 weeks’ pay.

You will not be paid any more than the statutory limit, which weekly pay is currently capped at £566.

NOTE:

This statutory limit is subject to change each year around April. You can check whether the statutory limit of £566 has changed by visiting:

www.gov.uk/redundancy-your-rights/redundancy-pay

The Notice Pay Decision Tree

Strictly speaking, you are not entitled to statutory notice pay. Instead, your entitlement is to statutory notice. Accordingly, if you are not given all of the statutory notice to which you are entitled, the debt which is owed to you consists only of the financial loss (if any)which you have sustained as a result of that failure to provide you with that notice.

Therefore, in this document, any references to ‘notice pay’ is, in reality, a reference to the loss (if any) which you have sustained as a result of that failure to provide you with

statutory notice.

In respect of ‘notice pay’ debt:

- Should you make an industrial tribunal claim against your employer?

- Or, instead, can you make an application, to the Redundancy Payments Service,

for a payment in respect of that debt?

Use the ‘Notice Pay’ decision tree below, for guidance:

If the Redundancy Payments Service makes a payment to you, in respect of notice pay, that

payment will be calculated in the following manner:

- First, the Redundancy Payments Service will calculate the amount of net pay (after tax and national insurance deductions) which you would have received from your employer if they had provided you with all of the statutory notice to which you were entitled.

- Secondly, the following deductions will be made from that amount:

(1) Net pay received from any new employer in respect of any part of the notice period.

(2) Any social security benefits to which you became entitled, because of your

unemployment during all of, or any part of, that notice period.

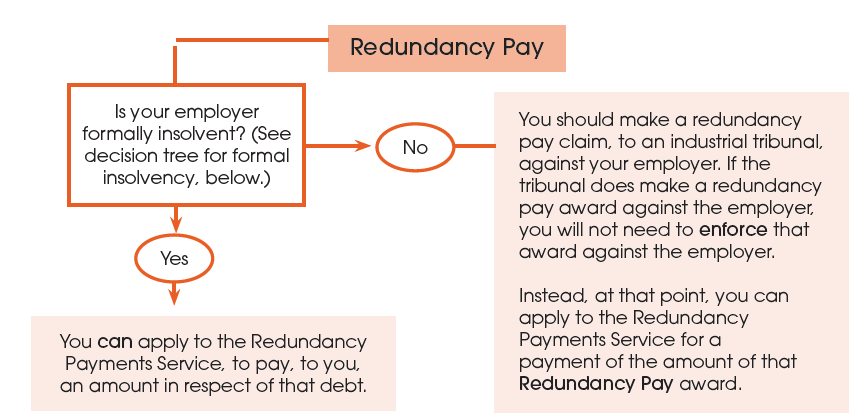

The Redundancy Pay Decision Tree

In respect of ‘redundancy pay’ debt:

- Should you make an industrial tribunal claim against your employer?

- Or, instead, can you make an application, to the Redundancy Payments Service,

for a payment in respect of that debt?

Use the ‘Redundancy Pay’ decision tree below, for guidance:

Any amount paid to you, by the Redundancy Payments Service, in respect of a redundancy payment, will be calculated on the basis of your:

- Weekly gross pay

- Length of service

- Age during each year of service

To find out how much redundancy pay you may be entitled to, you should visit the online redundancy calculator at www.gov.uk/calculate-your-redundancy-pay.

NOTE:

You will only be entitled to redundancy pay if you have worked continuously for the employer for at least 2 years.

At some time, during the six months immediately after your dismissal, you should write to

your employer, claiming your redundancy payment. (If you do not do so, you may possibly

lose your entitlement to redundancy pay.)

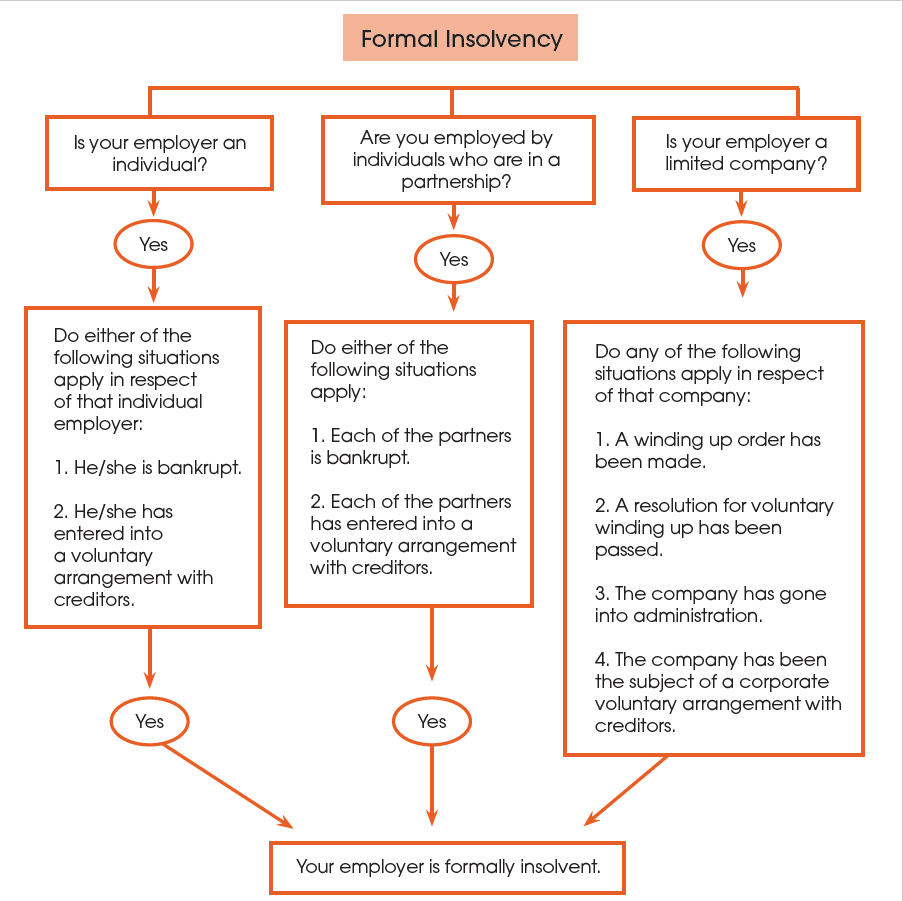

The ‘Formal Insolvency’ Decision Tree

For present purposes, your employer will not be ‘formally insolvent’ just because thatemployer cannot afford to pay the debts which are owed to you.

In the present context, ‘formal insolvency’ has a special meaning. The decision tree below highlights the main situations in which an employer will be deemed to be formally insolvent.